Forex Blog |

| Posted: 08 Jul 2009 10:52 PM PDT Over the last few weeks, the stock market rally has fizzled and commodities prices have cooled off. It’s not clear what triggered this sudden surge in introspection (I would call it reasonableness). Regardless, the markets are now wondering out loud whether the optimism of the second quarter wasn’t a bit naive. After all, there still isn’t any evidence that global economy has turned a corner. Virtually all of the economic indicators that matter are still trending downwards. In addition, the apparent stabilization in housing prices could prove temporary, as banks move away from loan modifications and back towards foreclosure. Rumors that the Obama administration are considering a second stimulus plan are already circulating With second quarter corporate earnings season set to kick off next week, investors are once again bracing for the worst: “Given the strong performance of stocks relative to March lows, a reality check from earnings could be detrimental to risk appetite.” Adds another analyst, “It’s renewed risk aversion, triggered by mounting doubts about a near-term economic recovery that’s evident in the sell-off on Wall Street and the subsequent decline in risk assets in general.” This pickup in risk aversion is also manifesting itself in forex markets, via the upturns in both the US Dollar and Japanese Yen: “The prospect of a slow and bumpy recovery remained the overriding driver of market sentiment and the dollar was soon reasserting itself as the currency of choice - apart from the yen.” Ironically, negative economic data that applies directly to the US is benefiting the Dollar, which goes a long way towards explaining the current market orientation. Currency traders have yet to turn towards comparative growth differentials (despite the predictions of some analysts) and remain firmly focused on risk. Meanwhile, “The yen rally has extended, driven by the liquidation of long-risk asset positions.” In other words, the carry trade has come under pressure as investors move back into low-risk government bonds.

|

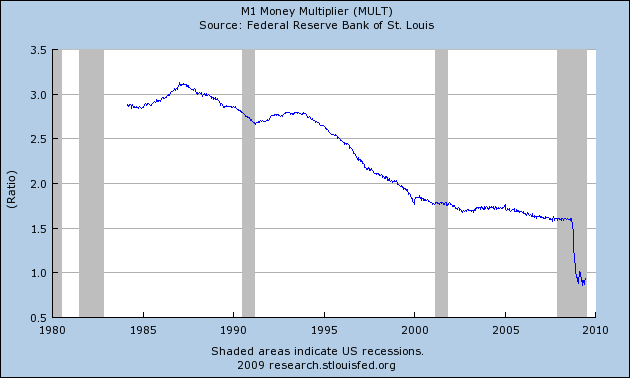

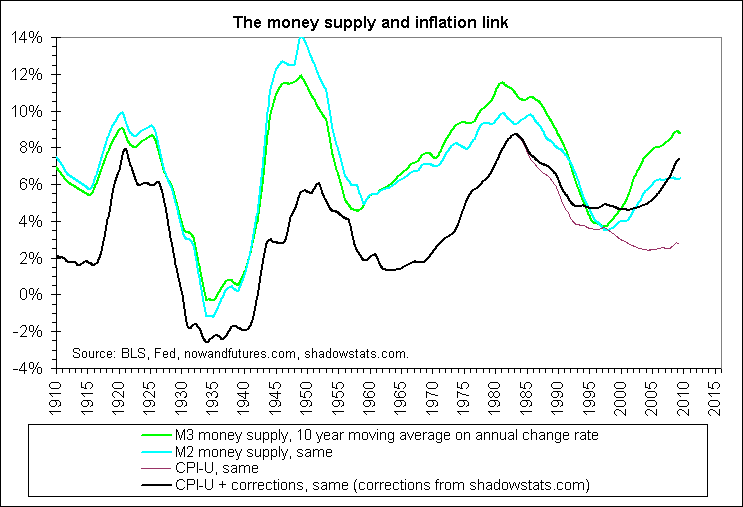

| Inflation Update: US Prices Creep up in May Posted: 08 Jul 2009 03:17 AM PDT The debate over US inflation continues to be waged- in academic circles, among economists, and in the financial markets. There is no still no clear consensus as to the likelihood that the inflation will flare up at some point, as a result of the Fed’s easy monetary policy and the government’s record budget deficits. While the unprecedented nature of this crisis means that such a debate is still a matter of theory, that hasn’t stopped both sides from weighing in, often vehemently. Admittedly, the risk of inflation in the short-term is still low: “With so much of the world ensnared by the economic downturn, demand for goods and services is weak, which tends to push down prices. Amid high unemployment, workers are in no position to demand wage increases.” Still, the Consumer Price Index (CPI) is already creeping up. The Fed’s “core” measure, which excludes food and energy prices, rose 1.8% from a year ago. If commodity prices continue to rise, the total CPI could soon become positive. (It currently stands at -1.3%). Among academics and economists, the discussion is being framed relative to the Fed; specifically, can it - and more importantly, will it - move to unwind its quantitative easing program when the time comes? “If it acts prematurely to reduce the money supply, the Fed could stifle the recovery. If it waits too long, it could contribute to a jump in inflation. Its timing is going to have to be perfect,” says a former Fed economist. This question remains divisive, as evidenced by the ongoing feud between the chief economist at Morgan Stanley and his counterpart over at Goldman Sachs. MS is concerned that the Fed will leave rates too long. According to one of his supporters, “The Fed absolutely has the tools and know-how, but the question is, will they have the guts to use them? I don't think there is a snowball's chance in hell they will be willing to tighten to slow inflation down.” Counters the GS camp: “"The Fed will be able to contain inflation pressures through a combination of raising interest rates and unwinding its balance sheets." All of this talk seems premature when you consider that the money supply is barely growing, despite the Fed’s QE program: “M2, a gauge that includes savings and checking accounts, is 4.7 times the base cash supply, down from 9.3 times a year ago.”

“Of the $2.1 trillion that the Fed is injecting into the financial system, more than half, or 51 cents per dollar, is being posted back at the central bank by financial institutions in the form of excess reserves, a record high.” In other words, most of the Fed’s cash is not actually finding its way to consumers.

|

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

Inbox too full?  | |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The “uncertainty” narrative will likely continue to drive the markets for the near-term, as neither the optimists nor the pessimists have the data to support their respective positions. In all likelihood, the markets will trend sideways and safe haven currencies will see a slight inflow, until there is confirmation that the economy is firmly on the path to recovery.

The “uncertainty” narrative will likely continue to drive the markets for the near-term, as neither the optimists nor the pessimists have the data to support their respective positions. In all likelihood, the markets will trend sideways and safe haven currencies will see a slight inflow, until there is confirmation that the economy is firmly on the path to recovery.

No comments:

Post a Comment