Forex Blog |

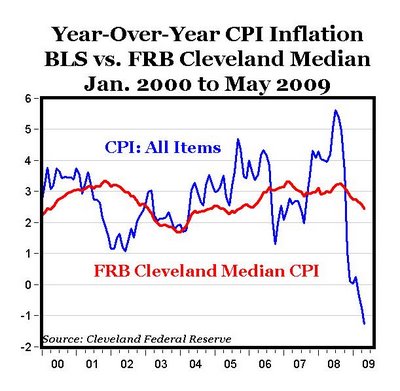

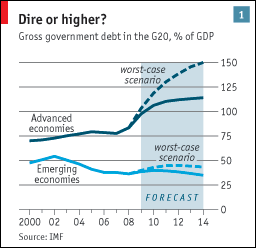

| Can the Fed Control Inflation? Posted: 21 Jun 2009 11:57 PM PDT This week, the Federal Reserve Bank is scheduled to meet for two days, during which it will debate not only whether or not to adjust its benchmark interest rate but also whether to tweak its Quantitative-Easing program, which is slated to end in August. Futures prices indicate an expectation of nil that the Fed will tighten its monetary policy. Still, there is a definite possibility that the Fed will vote to continue injecting liquidity into credit markets: “Market watchers want to hear if the Fed will announce a plan to buy more than the original $300 billion in long-term Treasurys in order to help tamp down interest rates and keep credit flowing.” In this context, it’s worth asking: Is the Fed focusing on growth at the expense of inflation? To be fair, inflation is currently non-existent. Prices rose at an annualized rate of .3% last month, and have actually fallen, relative to last year. Commodity prices are indeed rising, but seem to be taking their cues from the stock market and abnormal/temporary shocks, rather than a real change in the dynamic between supply and demand. The Dollar is also falling, but Bernanke himself has argued previously that this shouldn’t trickle down to the consumer price level in a significant way.  Meanwhile, GDP is negative and unemployment is rising. The ubiquitous talk of “green shoots” notwithstanding, there is still no solid evidence that the economy has begun to recover. In short, if it’s question of priorities, you can’ fault the Fed for focusing on the economy instead of price stability. “A nation can endure high inflation for a time without destroying its long-term economic prospects…On the other hand, economic depressions have far more severe aftereffects and require more drastic measures to solve,” agrees one analyst. Still, the concern is not that a sudden economic turnaround will drive domestic inflation. "There is growth in the emerging markets…There's an international demand as well as a U.S. demand. The inflationary pressures are going to be coming from outside the walls of Troy." But even this is small beer compared to the Fed’s quantitative easing program and the record-setting government budget deficits. Fed apologists argue that QE was implemented with the implicit understanding that all of the excess cash would be siphoned out of the system long before the economy returned to full steam. “The Fed is well aware of the exit problem. It is planning for it, is competent enough to carry out its responsibilities and has committed itself to an inflation target of just under 2 percent. Of course, none of that assures us that the Fed will hit the bull's-eye. It might miss and produce, say, inflation of 3 percent or 4 percent at the end of the crisis — but not 8 or 10 percent,” asserts one economist. He points out that the bond markets agree with this assessment: “The market's [five-year] implied forecast of future inflation…was about 1.6 percent and the 10-year expected rate was about 1.9 percent. Notice that the latter matches the Fed's inflation target.” Without doing an in-depth, historical study, it’s still reasonable to say that investors are prone to making errors. Consider the euphoria surrounding mortgage bonds up until that bubble burst last year, that in hindsight was completely baseless. With regard to the Fed, one need look no further than the artificially low monetary policy maintained by Bernanke’s predecessor, Aland Greenspan, that has since been blamed for the current recession. According to a WSJ analysis, ”There is no evidence that Mr. Bernanke and his Fed colleagues have changed their thinking…But this time, the Fed has also gone to greater easing lengths than it ever has, taking short-rates nearly to zero and making direct purchases of mortgage securities and even Treasuries. These are extraordinary acts that push the Fed deeply into fiscal policy, credit allocation and directly monetizing Treasury debt. Combined with the 2003-2005 mistake, they have also raised grave doubts about the Fed’s credibility and independence.” Then there is the fact that the optimistic forecasts hinge on two crucial assumptions. The first is that the economy will indeed recover and that record government (not just the US) deficits will soon abate. The second assumption is that regardless of whether the global economy improves swiftly and convincingly, the increase in sovereign debt can be absorbed by the capital markets. In my opinion, this assumption is both wrong and negligent. Even the optimists expect the ratio of G20 gross national debt to GDP, to surpass 100% for the first time ever this year. [Chart courtesy of The Economist]. Let’s just hope that the investors continue to turn out, and that Central Banks (including the Fed) aren’t stuck mopping up the difference.   |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

Inbox too full?  | |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment